SBA Loan Business Plans: How to Prepare a Solid Document That Opens the Door to Funding

Introduction

Securing business financing in the United States through the Small Business Administration (SBA) can be a decisive opportunity to launch or expand your company. However, loan approval depends heavily on the quality of the business plan accompanying the application.

At VisaBP.com, we develop professional, customized business plans designed specifically to meet the criteria used by the SBA and its partner banks when evaluating credit applications.

Unlike generic or automated templates, our deliverables combine financial precision, business storytelling, and a bank-oriented structure, ensuring that every projection and objective aligns with lender expectations.

What Is the SBA and How Does the Loan Process Work?

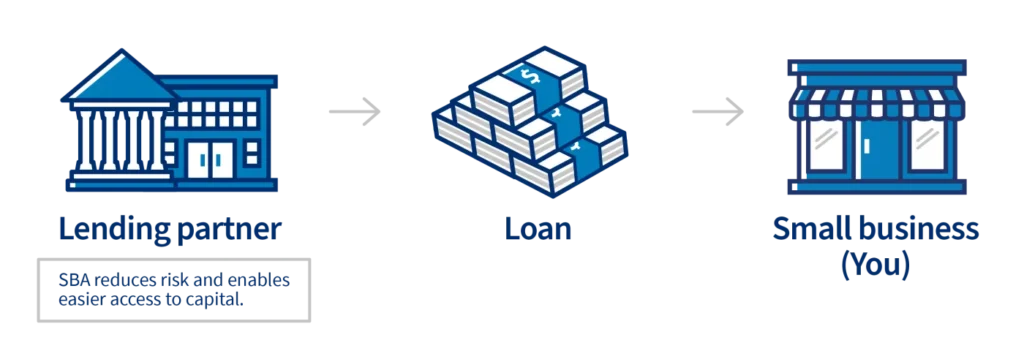

The Small Business Administration (SBA) is a U.S. federal agency created in 1953 to support the growth and financing of small and medium-sized businesses. It does not operate as a bank or lend money directly. Instead, it guarantees a portion of loans that entrepreneurs request from approved financial institutions.

In simple terms, the SBA reduces the lender’s risk, allowing banks and credit unions to offer financing to businesses that might not otherwise qualify through traditional channels. With this guarantee, lenders can approve larger amounts, longer terms, and competitive interest rates.

Here’s how the process works:

The entrepreneur submits a loan application to a participating bank or partner institution, attaching the business plan, financial statements, projections, and supporting documentation. The lender evaluates the project’s feasibility and, if it meets the requirements, sends it to the SBA, which guarantees a portion of the loan—usually between 50% and 85%, depending on the program.

Once the guarantee is approved, the bank releases the funds and manages the credit. The SBA acts as a guarantor in case of default, ensuring the financial system maintains confidence and continuity in supporting small businesses.

This model makes the SBA a strategic bridge between the private and public sectors, and a key part of the U.S. entrepreneurial ecosystem. To benefit from it, your business plan must demonstrate management capacity, profitability, and sustainable projections—all crucial factors in the SBA’s risk analysis.

Why the SBA Requires a Business Plan

The SBA does not lend directly; it works with banks, credit unions, and certified lenders that follow its guidelines. In this process, the business plan plays a critical role: it demonstrates that the applicant understands the market, has a viable strategy, and can repay the loan.

A strong plan is not just a formality—it is a risk assessment tool. Lenders use it to measure management ability, projected cash flow strength, and overall business sustainability.

An incomplete or generic plan can easily mean the difference between approval and rejection.

How We Build SBA-Ready Business Plans

Every VisaBP plan is developed based on the evaluation criteria used by SBA-approved lenders and includes all key elements that carry weight in their review:

- Clear and focused executive summary: Explains the nature of the business, the amount requested, and how funds will be used.

- Detailed market analysis: Includes customer segmentation, competition, industry trends, and comparative advantages.

- Operational and organizational strategy: Defines management structure, administrative roles, and internal control policies.

- Verifiable financial projections: Presents income statements, cash flow, and balance sheet projections grounded in realistic assumptions and official sources.

- Debt Service Coverage Ratio (DSCR): Calculates the borrower’s capacity to meet loan payments based on operating income.

- Technical annexes and supporting documentation: Includes licenses, quotes, agreements, contracts, and letters of intent that validate financial assumptions.

Additionally, we tailor each plan to the specific SBA loan program being requested, since every program has distinct requirements.

Types of SBA Loans and Their Connection to the Business Plan

SBA 7(a) Loan Program

This is the most widely used SBA program. It supports working capital, inventory purchases, fixed asset acquisition, or debt refinancing.

The business plan must demonstrate income generation capacity, financial stability, and clarity in how funds will be used.

Credit officers evaluate whether projected cash flow can cover loan payments and whether the business has a reliable record or collateral to minimize risk.

SBA 504 Loan Program

This program is designed for the purchase of commercial real estate or high-value equipment. In these cases, the business plan should include long-term projections, local job creation impact, and sustainability of the investment.

Lenders and Certified Development Companies (CDCs) pay particular attention to productivity indicators and return on investment (ROI).

SBA Microloan Program

This program supports microenterprises and startups seeking smaller amounts (up to $50,000 USD). The plan should present a simple but persuasive structure, showing local demand evidence and a clear strategy for achieving profitability.

Other Relevant SBA Programs

We also prepare business plans for SBA Express Loans, Community Advantage, and other specialized programs for women entrepreneurs, minority-owned businesses, and veterans, each with unique eligibility and documentation requirements.

Common Mistakes That Can Lead to Rejection

One of the most frequent reasons for denial is submitting generic business plans, often produced by AI tools or firms unfamiliar with the U.S. banking system. Many applicants, in an attempt to save time or money, deliver superficial documents lacking financial depth or internal consistency.

An SBA business plan must go far beyond describing a business—it must prove repayment capacity, realistic planning, and responsible management.

Our Work Process

We build each business plan through a comprehensive interview and financial assessment with the applicant. Using this information, we organize the content, verify financial accuracy, and align the narrative with SBA lender evaluation criteria.

Throughout the process, we maintain constant communication to validate data, review assumptions, and ensure the final document is consistent, credible, and ready for submission.

The result is a complete, professional, and editable plan, ready to present to any bank, credit union, or SBA-approved intermediary.

Why Choose VisaBP.com

At VisaBP.com, we have a proven track record in developing financial and immigration business plans, allowing us to deliver documents that are technically solid and strategically structured.

Our plans combine economic analysis, professional writing, and institutional formatting, meeting the standards required by banks, credit unions, and SBA-affiliated institutions.

Over the years, we have helped countless entrepreneurs successfully obtain business financing through SBA programs. We understand the specific needs of each profile and tailor every plan to reflect the real context of your business in the United States.

Additionally, our business plans can be dual-purpose, serving not only for financing but also as a foundation for future immigration applications related to business or investment—such as EB-2 NIW, E-2, L-1, or EB-5. This approach ensures that the same financial document can strengthen both your loan application and your long-term immigration strategy.

Every plan complies with the SBA Business Plan Tool and follows the U.S. Small Business Development Center (SBDC) guidelines, ensuring clarity, consistency, and adherence to the formal criteria expected by lenders and U.S. authorities.

Frequently Asked Questions

Does the SBA require a specific business plan format?

No, there is no single official format. However, the SBA recommends including sections that describe the business’s financial, operational, and market structure.

How long does the process take?

Preparing an SBA business plan typically takes around 15 days, depending on the business complexity and information available. Once submitted, SBA and bank approval may take two to three weeks, though this varies by lender and program type.

For urgent cases, we offer an express service to complete the plan within a shorter timeframe—ideal for tight deadlines or fast-track financing needs.

Can I use an existing business plan for an SBA loan?

Yes, as long as it meets current evaluation standards. However, most plans require updates and adjustments to match lender requirements.

Do you assist with the loan submission process?

Our service focuses on the technical preparation of the business plan and providing strategic business guidance. The formal submission to the bank or SBA must be done directly by the applicant.

Conclusion

A well-structured SBA business plan can be the key to loan approval. More than a requirement, it demonstrates planning, financial solvency, and business vision.

At VisaBP, we help you craft a document that reflects the real potential of your business, fully aligned with the standards expected by the SBA and its partner lenders.

Contact us today to request an initial assessment and begin your financing process with a business plan designed to convince any lender.